FairTax

2007 Schools Wikipedia Selection. Related subjects: Politics and government

The FairTax (H.R.25/S.25) is a proposal for changing United States tax laws to replace the Internal Revenue Service (IRS) and all federal income taxes (including AMT), payroll taxes (including Social Security and Medicare taxes), corporate taxes, capital gains taxes, gift taxes and inheritance taxes with a national retail sales tax, to be levied once at the point of purchase on all new goods and services. Apart from funding, the legislation would not change government programs such as Social Security, Medicare, and Medicaid. The proposal also calls for a monthly tax rebate to households of citizens and legal resident aliens, to "untax" purchases up to the poverty level. The sales tax rate would be 23% of the total register price when calculated the same way as income taxes, which is the same as a 30% traditional sales tax. Due to the rebate, the effective tax rate is progressive on consumption and could result in a tax burden of zero or less. Opponents assert that the tax would be regressive on income, and (based on modified sales tax studies) would shift the tax burden from those with a higher income to those with a lower income and primarily benefit wealthy individuals, while the plan's supporters argue that it would broaden the tax base, increase purchasing power, decrease tax burdens, and tax wealth.

Because the income tax structure of the United States embeds multiple taxes in the costs of goods and services, the FairTax is expected to decrease production costs after business taxes and compliance costs are removed. This is predicted to offset a portion of the FairTax amount. Proponents expect the FairTax to have positive ramifications for savings and investment (not taxed), transparency (taxes are visible on each receipt), ease of compliance (no tax planning), economic growth, international business locality (businesses will be more inclined to produce in the U.S.), and U.S. international competitiveness (decreased U.S. production costs). However, critics argue that it could be difficult to collect, having challenges with an underground economy (avoiding the tax), and that it may not yield enough money for the government, resulting in cuts to governmental programs, increased deficit, or a higher tax rate. Additionally, it may be difficult to permanently eliminate income taxation, as it would require a constitutional amendment to aggressively repeal the Sixteenth Amendment to the United States Constitution.

Legislative history

The FairTax plan was created by Americans For Fair Taxation, an advocacy group formed for this purpose. The group developed the plan and the name Fair Tax with economists based on interviews, polls and focus groups of the general public.

Georgia Republican John Linder first introduced the FairTax Bill in July 1999 to the 106th United States Congress. He has reintroduced substantially the same bill in each subsequent session of Congress. While the bill attracted a total of 56 House and Senate cosponsors in 2004 and 61 in 2006, it has not been voted on by any committee in either the House or Senate. In order to become law, the bill will need to be included in a final version of tax legislation from either the U.S. House Committee on Ways and Means or U.S. Senate Finance Committee, then obtain support from the Joint Committee on Taxation, and finally pass both the House and the Senate.

The current FairTax legislation was introduced by Linder in the House and by Georgia Republican Senator Saxby Chambliss in the Senate. Its formal name is the Fair Tax Act of 2005. The bill is supported by Speaker of the House Dennis Hastert but has not received support from the Democratic leadership. Democratic Representative Collin Peterson of Minnesota and Democratic Senator Zell Miller of Georgia cosponsored and introduced the bill in the 108th Congress, but Peterson is no longer cosponsoring the bill and Miller has left the Senate. In the 109th Congress, Democratic Representative Dan Boren has cosponsored the bill.

Other current attempts to replace the U.S. tax system have attracted fewer cosponsors. The Flat tax sponsored by Texas Republican Michael C. Burgess in the House has 6 cosponsors, and no other proposal has as many.

Tax rate

Sales tax rate

The FairTax legislation would apply a 23% federal retail sales tax on the total transaction value of new retail goods and services purchases; in other words, consumers pay to the government 23 cents of every dollar spent (sometimes called tax-inclusive — as income taxes are calculated). The assessed tax rate is 30% if the FairTax is added to the pre-tax price of a good like traditional U.S. sales taxes (sometimes called tax-exclusive). The FairTax legislation uses total transaction value (tax-inclusive) in presenting the rate; with an item purchased for $100, the retailer receives $77 and the remaining is collected for the federal government. However, American sales taxes have historically been expressed as a percentage of the original sale price (tax-exclusive); items priced at $100 pre-tax cost $130 with the tax added. The use of the tax-inclusive number in presenting the rate has been criticized as deceptive by the plan's opponents. Proponents argue that the 23% number represents a better comparison to income tax rates, which are presented as inclusive rates (see Presentation of tax rate). Critics also argue that the sales tax rate would need to be higher in order to be revenue neutral (see Revenue neutrality).

A good would be considered "used" and not taxable if a consumer already owns it before the FairTax takes effect or if the FairTax has already been paid on the good. The FairTax would tax all services provided at the retail level. Personal services such as health care, legal services, haircuts and auto repairs would be subject to the FairTax, as would renting apartments and other real property. State sales taxes do not generally tax such services. Education, training, saving and financial investing would be considered an investment (rather than final consumption) and therefore would not be taxed.

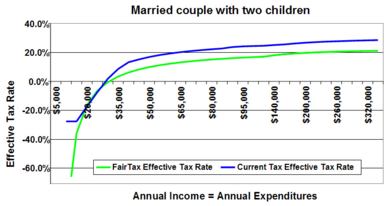

Effective tax rate

The effective tax rate for any household would be variable due to the fixed monthly tax rebates. The rebates would have the greatest impact at low spending levels, where they could lower a household's effective rate to zero or a negative rate. At higher spending levels, the rebate has less impact, and a household's effective tax rate would approach 23% of total spending. For example, a household of three spending $30,000 a year on taxable items would devote about 6% of total spending to the FairTax after the rebate. A household spending $125,000 on taxable items would spend around 19% on the FairTax. The total amount of spending and the proportion of spending allocated to taxable items would determine a household's effective tax rate.

The lowest effective tax rate under the FairTax could be negative due to the rebate. This could occur when a household spends less and pays less in taxes than the average poverty level spending for a similar household size. Buying or otherwise receiving used items can also contribute towards a negative rate. Here, the household's rebate would exceed actual taxes paid by that household. To determine the effective tax rate for consuming all income on new goods and services: ((income * tax rate) – rebate) / income = effective tax rate.

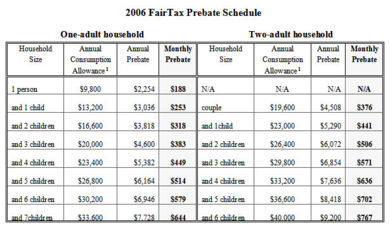

Monthly tax rebate

Under the FairTax, households would receive a monthly tax rebate (known as a "prebate" as it would be paid in advance) equal to the estimated total FairTax paid on poverty level spending according to the poverty guidelines published by the U.S. Department of Health and Human Services. The poverty level guidelines vary by family size and represent the cost to purchase household necessities. The rebate would be paid in twelve monthly installments equal to 23% of poverty level spending for each household size and is meant to eliminate the taxation of necessities and make the plan progressive. The formula used to calculate rebate amounts would be adjusted for inflation. To become eligible for the rebate, households would register once a year with their sales tax administering authority, providing the names and social security numbers of each household member. The Social Security Administration would disburse the monthly rebate payments in the form of a paper check via U.S. Mail, an electronic funds transfer to a bank account, or a “ smartcard” that can be used much like a bank debit card. The National Taxpayers Union estimated that the annual cost of mailing monthly rebate checks via the U.S. Post Office would be approximately $225 million.

The President's Advisory Panel on Federal Tax Reform cited the rebate as one of their chief concerns with the FairTax, calling it "the largest (entitlement program) in American history," and contending that it would "make most American families dependent on monthly checks from the federal government for a substantial portion of their incomes." However, if "substantial" was defined as a rebate that increased family income by 23% or more, according to the U.S. Census Bureau income statistics for 2005, "most American families" (claimed by the Tax Panel) would only equate to 12.6%. Based on the advisory panel's tax rate and base (which differs from the FairTax legislation by creating exemptions not defined in the proposal), "the Prebate program would cost more than all budgeted spending in 2006 on the Departments of Agriculture, Commerce, Defense, Education, Energy, Homeland Security, Housing and Urban Development, and Interior combined." The Beacon Hill Institute estimated the rebate cost to be $489 billion (assuming 100 percent participation). Proponents point out that income tax deductions, tax preferences, loopholes, credits, etc. under the current system was estimated at $945 billion by the Joint Committee on Taxation and that the IRS itself sent out $270 billion in refund checks for 2005. This is $456 billion more than the FairTax "entitlement" would spend to enable taxpayers to buy the necessities of life free from government tax.

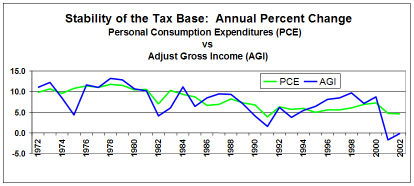

Revenue neutrality

A key component of the FairTax rate is the ability to be revenue-neutral — that is, it would not result in an increase or reduction in overall federal tax revenues. However, this is a matter of dispute, as economists, advisory groups and political advocacy groups disagree about the tax rate required for the FairTax to be truly revenue-neutral. Different researchers use different time frames and methodologies that make direct comparison among estimates difficult. The choice between static or dynamic scoring further complicates any estimate of revenue-neutral rates. The rates presented below are based on a static scoring analysis and adhere to the legislative framework of the FairTax bill in rate presentation, which is calculated as a percentage of total spending, sometimes called a tax-inclusive rate. To adjust any rate below to that of a traditional sales tax, divide the rate by 1 minus the rate (refer to Presentation of tax rate for calculations).

Americans For Fair Taxation (AFFT) claim that Dale Jorgenson, a professor of economics at Harvard University and past President of the American Economics Association, helped develop the FairTax and estimated the revenue-neutral rate to be 22.9%. However, Dr. Jorgenson, in his 2002 book, indicated that he believes the revenue-neutral rate would need to be much higher (it is unknown what assumptions, changes, or tax base he was considering when he made this statement). Jim Poterba of the Massachusetts Institute of Technology estimated a rate of 23.1% using assumptions provided to him by AFFT. Laurence Kotlikoff of Boston University purportedly found a rate of around 24%. AFFT states that researchers at Stanford University, The Heritage Foundation, The Cato Institute, and Fiscal Associates have calculated revenue-neutral rates between 22.3% and 24%. However, AFFT funded this research and has not made these studies public. The studies are also not published by the economists that conducted those studies. Economist William Gale of the Brookings Institution published a detailed analysis that estimated a ten-year revenue-neutral rate of around 31% (on a tax-inclusive basis) assuming full taxpayer compliance. The Argus Group and Arduin, Laffer & Moore Econometrics both published analyses that defended the 23% rate. A detailed study published in 2006 by Beacon Hill Institute found the FairTax rate to be 23.82%.

Additional studies have been performed on National Retail Sales Tax plans that do not necessarily conform to the tax base as defined in the FairTax legislation but are often considered when discussing FairTax rates. These studies often claim the tax base or rate calculation methods used in the FairTax legislation is flawed or likely to be modified by Congress before passage. The President's Advisory Panel for Federal Tax Reform found the rate would need to be 25% in order to replace the income tax alone (i.e., it would need by be substantially higher to replace payroll taxes and the estate tax). However, the Chairman of the President's Advisory Panel, former U.S. Senator Connie Mack, stated that "the panel did not score H.R. 25” (the FairTax). The panel was not allowed to consider reforming regressive payroll taxes and they reduced the tax base by adding large exclusions. The panel explained that the tax base change and the higher rate was required due to several flaws it found in the FairTax proposal - including the counting of taxes government would pay to itself as revenues without similarly increasing the amount of government expenditures to pay these taxes, and an assumption of zero tax-evasion - which it considered unrealistic. FairTax proponents, including the Beacon Hill Institute, disagree with those conclusions.

The tax panel reported "For example, if a retail sales tax imposed a 30 percent tax on a good required for national defense, either the government would be required to pay that tax, thereby increasing the cost of maintaining current levels of national defense under the retail sales tax, or, if the government was exempt from retail sales tax, the estimate for the amount of revenue raised by the retail sales tax could not include tax on the government’s purchases. Failure to properly account for this effect is the most significant factor contributing to the FairTax proponents’ relatively low revenue-neutral tax rate. Second, FairTax proponents’ rate estimates also appear to assume that there would be absolutely no tax evasion in a retail sales tax. The Panel found the assumption that all taxpayers would be fully compliant with a full replacement retail sales tax to be unreasonable. The Panel instead made assumptions about evasion that it believes to be conservative and analyzed the tax rate using these evasion assumptions."

The Treasury Department estimates excluded government consumption from the base, which is about 18% of consumption. This significantly alters the tax base and therefore the tax rate. Other studies point out that the current system is also counting taxes the government would pay to itself by including matched payroll taxes of government employees, in addition to covering the corporate and payroll tax expenses of its contractors and their suppliers. The tax panel included large expenditures to local and state governments for the FairTax burden, however, the Beacon Hill Institute suggested a flaw in this logic and showed that the FairTax imposes no additional real fiscal burdens on state and local government. A similar level of taxation is required when shifting from taxing income to consumption in order to maintain the tax burden on government. Proponents assert that government needs to be taxed to keep a level playing field between government enterprises and private enterprises. Dr. Karen Walby, Director of Research for the Americans For Fair Taxation, discussed a recent study by Young & Associates on evasion and enforcement that identifies certain key variables which influence the level of compliance (marginal tax rates, likelihood of audit, severity of penalties, etc) and concludes the FairTax is superior on most/all of these and would therefore have lower rates of evasion than alternatives. While the FairTax studies did not consider tax evasion, neither did they ignore it. The studies have implicitly incorporated a significant degree of tax evasion in calculations simply by using National Income and Product Account based figures that understate total household consumption. In addition, the studies did not consider the increased economic growth that economists and FairTax supporters believe would occur.

Congress’s bipartisan Joint Committee on Taxation evaluated a proposal similar to FairTax that included additional exemptions and estimated a revenue-neutral rate of around 36%. In a 2004 study, the Institute on Taxation and Economic Policy examined the FairTax proposal and contends that by excluding certain levels of taxation it calls "phantom" (sales to the government, church and nonprofit transactions, etc.), a national sales tax rate would have to be upwards of 36% to be revenue-neutral. Proponents charge that the Presidential Tax Panel, the JCT, and ITEP are motivated to maintain the "status quo" and thus modify the tax base from the proposed legislation to achieve higher rates. Proponents claim that it is circular logic for critics of the FairTax to modify the tax base to create a higher rate and to then justify greater evasion, making an even higher rate, which also makes the rebate much more expensive. Proponents further state that since opponents could not kill the FairTax proposal based on merits or lack thereof; they create their own plan with an exaggerated rate to make it politically not feasible.

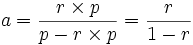

Presentation of tax rate

The current tax system imposes taxes primarily on income. The tax base is a household's pre-tax income. The appropriate income tax rate is applied to the tax base to calculate taxes owed. Under this formula, taxes to be paid are included in the base on which the tax rate is imposed. If an individual's gross income is $100 and income tax rate is 23%, taxes owed equals $23. The tax base of $100 can be treated as two parts—$77 of after-tax spending money and $23 of income taxes owed. The income tax is taken "off the top", so the individual is left with $77 in after-tax money.

Traditional sales tax laws impose taxes on a tax base equal to the pre-tax portion of a good's price. Unlike income taxes, U.S. sales taxes do not include actual taxes owed as part of the base. A good priced at $77 with a 30% sales tax rate yields $23 in taxes owed. Since the sales tax is added "on the top", the individual pays $23 of tax on $77 of pre-tax goods.

Since sales and income taxes behave differently due to differing definitions of tax base, direct rate comparisons between the two can be confusing. For direct rate comparisons between sales and income taxes, one rate must be manipulated to look like the other. However, this can cause some confusion when not explained properly. A 30% sales tax rate approximates a 23% income tax rate after adjustment. From the example above, an individual pays $23 of tax on $77 of goods. Total spending (pre-tax price and taxes owed) for that transaction equals $100. The $23 of taxes on $100 of total spending yields a 23% rate. By including taxes owed in the tax base, a sales tax rate can be directly compared to an income tax rate.

The FairTax rate, unlike most U.S. state-level sales taxes, would be calculated on a tax base that includes the amount of FairTax paid. In this manner, the FairTax, like European sales taxes, more closely resembles an income tax calculation. A final price of $100 includes $23 of taxes. Like the income tax example above, the taxes to be paid would be included in the base on which the FairTax is imposed. The FairTax is presented as a 23% tax rate for easy comparison to income tax rates. If you are in a 25% income tax bracket, you will pay $25 in federal income taxes out every $100 you earn. With the 23% FairTax, you would pay $23 in taxes out of every $100 you spend.

The plan's opponents call this deceptive - Laurence Vance, writing for the Ludwig von Mises Institute, goes so far as to call it a "lie". According to Vance, "Boortz's 'mathematical equivalent of a game of semantics' still results in a FairTax rate of 30 percent. This is why Boortz prefers the national sales tax to be included in the price of each item—so the consumer doesn't realize that he is really paying an extra 30 percent in sales tax, not Boortz's new math amount of 23 percent." When looking at other rate studies that report a 36% rate, the equivalent traditional sales tax rate would be 56%.

- Comparison to a typical sales rate:

- Let r be the FairTax rate. i.e. if the rate was 30%, then r = 0.30

- Let a be the FairTax rate in terms of a typical sales tax.

- Let p be the price of the good.

- The revenue that would go to the government is:

- This means the revenue remaining for the seller of the good is:

- In a traditional sales tax system, sales tax is calculated as the fraction of the money going to the company that must be paid to the government. For example, with a traditional 10% sales tax, the government would receive $10 when a company receives $100. Thus, to convert the tax we divide the money going to the government by the money the company nets:

This means that to adjust any rate below to that of a traditional sales tax, one can divide the given rate by 1 minus that rate.

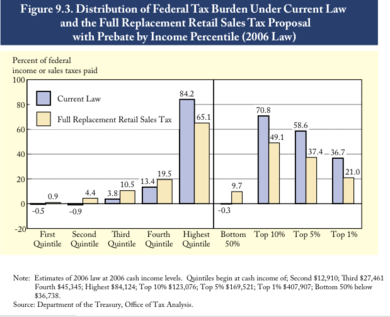

Distribution of tax burden

The FairTax's impact on the distribution of taxation is a point of significant dispute. The plan's supporters argue that it would broaden the tax base, be progressive and start taxing wealth, while opponents argue that a national sales tax would be inherently regressive and would decrease tax burdens paid by high-income individuals. Sales taxes are normally considered regressive, however, the FairTax provides a rebate that supporters argue would create a progressive effective rate on consumption. Under the FairTax, a low-income family may spend $25,000 on goods and services consuming 100% of their income. A higher income family making $100,000 may spend $80,000 on goods and services and save $20,000. The higher income family is consuming only 80% of their income on taxable goods and services. According to Economist William G. Gale, the percentage of income taxed is regressive. However, when presented with an estimated effective tax rate, the low-income family above would pay a tax rate of 0% on the 100% of consumption and the higher income family would pay a tax rate of 15% on the 80% of consumption. The effective tax rate is progressive on consumption.

Households at the lower end of the income scale spend almost all their income, while households at the higher end are more likely to devote a portion of income to saving; households at the extreme high end of consumption often finance their purchases out of savings, not income. This savings would be taxed when it becomes a purchase. Income earned and saved would not be taxed immediately under the proposal. In other words, savings would be spent at some point in the future and taxed according to that consumption. FairTax advocates state that this would improve taxing of wealth. Economist Laurence Kotlikoff stated that the FairTax could make the tax system much more progressive and generationally equitable. "Their view that taxing sales is regressive is just plain wrong. Taxing consumption is effectively the same as taxing wages plus taxing wealth." The payroll tax system is regressive on income with no standard deduction or personal exemptions taxing only the first $94,200 from gross wages, and none earned from capital investments or interest. The Centre on Budget and Policy Priorities states that three-fourths of taxpayers pay more in payroll taxes than they do in income taxes. Under the FairTax, it would be eliminated. Kotlikoff finds that the FairTax significantly reduces marginal taxes on work and saving, substantially lowers overall average remaining lifetime tax burdens on current and future workers at all income levels.

The President's Advisory Panel for Federal Tax Reform and Economist William Gale analyzed a National Sales Tax similar to the FairTax (though also different in several aspects) and reported that the overall tax burden on middle-income Americans would increase while the tax burden on the very rich would drop. FairTax supporters argue that the tax burden would shift to those who do not pay taxes under the current system. The FairTax would dramatically broaden the tax base to include all 300 million Americans and an estimated 30 million to 40 million foreign tourists and visitors. This would more than double the federal government's tax base. A study on marginal and average tax rates found that the FairTax would reduce most households’ average lifetime tax rates and, often, by a lot. Economists at Boston University found that the FairTax rewards low-income households with 26.7 percent more purchasing power, middle-income households with 10.9 percent more purchasing power, and high-income households with 4.7 percent more purchasing power.

Predicted effects

The FairTax proposal would have effects in many areas that influence the United States. FairTax proponents assert that the proposal would provide tax burden visibility and reduce compliance costs. The cost of federal government would be highly visible as consumers would see most of this cost in a single tax paid every time they purchase a good or service. Under the current tax system, the federal government collects revenue through a wide variety of taxes on individuals and businesses, which may not be fully visible to individual citizens. The efficiency cost of the current tax system — the output that is lost over and above the tax itself — is between $240 billion and $600 billion every year according to a 2005 report from the U.S. Government Accountability Office. Supporters argue that the FairTax system would reduce these compliance and efficiency costs by 90% and return a larger share of that money to the productive economy.

In an open letter to the President, the Congress, and the American people, seventy-five economists, including Nobel Laureate Vernon L. Smith, stated that the FairTax would boost the United States economy. According to the National Bureau of Economic Research and Americans For Fair Taxation, GDP would increase almost 10.5% in the year after the FairTax goes into effect. In addition, the incentive to work would increase by as much as 20%, the economy’s capital stock would increase by 42%, labor supply by 4%, output by 12%, and real wage rate by 8%. Further, studies of the FairTax at Boston University and Rice University suggest the FairTax will bring long-term interest rates down by as much as one third. As falling tax compliance costs lower production costs, exports would increase by 26% initially and remain more than 13% above present levels. According to Professor Dale Jorgenson of Harvard University’s Economics Department, revenues to Social Security and Medicare would double as the size of the economy doubles within 15 years after passage of the FairTax. Opponents offer a study commissioned by the National Retail Federation in 2000 that found a national sales tax would bring a 3 year decline in the economy, a 4 year decline in employment and an 8 year decline in consumer spending.

Global corporations consider local tax structures when making planning and capital investment decisions. Lower corporate tax rates and favorable transfer pricing regulations can induce higher corporate investment in a given locality. The United States currently has the highest combined statutory corporate income tax rate among OECD countries. Bill Archer, former head of the House Ways and Means Committee, asked Princeton University econometricists to survey 500 European and Asian companies regarding the impact on their business decisions if the United States enacted the FairTax. 400 of those companies stated they would build their next plant in the United States, and 100 companies said they would move their corporate headquarters to the United States. In addition, the U.S. is currently the only one of the 30 OECD countries with no border adjustment element in its tax system. Proponents state that because the FairTax is automatically border adjustable, the 17% competitive advantage, on average, of foreign producers would be eliminated, immediately boosting U.S. competitiveness overseas and at home. In The FairTax Book, Boortz and Linder assert that an estimated ten trillion dollars are held in foreign accounts, largely for tax purposes and predict a large portion of those funds would become available to U.S. capital markets, bringing down interest rates, and otherwise promoting economic growth in the United States.

The current federal tax law allows individuals to deduct the home mortgage interest costs, and donations to certain charities, from taxable income. Someone paying a 25% income tax rate would pay $250 in taxes on a $1,000 donation or mortgage interest payment, and then receive $250 back from the government as the $1000 deduction is removed from taxable income. The FairTax is tax free on mortgage interest up to the basic interest rate as determined by the Federal Reserve and donations are not taxed. The FairTax may also affect State and local government debt as the federal income tax system provides tax advantages to state and local municipal bonds. Other areas affected may be law enforcement as avoidance of income tax is sometimes used to prosecute members of organized crime syndicates to convict on charges of tax avoidance and tax evasion when insufficient direct evidence exists for other crimes. Under the FairTax proposal, this avenue of law enforcement would disappear as there would be no income tax and, therefore, no income tax evasion. However, individuals such as illegal immigrants may benefit as there would also be no federal tax savings to companies that hire illegal immigrants. Advocates claim the FairTax would provide incentive for illegal immigrants to legalize as they would otherwise not receive the FairTax rebate, paying the maximum effective tax rate.

Changes in the retail economy

Implementation

Like other firms, retailers would enjoy a zero corporate tax rate. Under the FairTax, retailers would be required to collect tax on all sales occurring within the United States. Retailers would receive a collection fee of .25% on federal funds collected. States that choose to conform to the federal base would have the added advantage of information sharing and clear interstate revenue allocation rules.

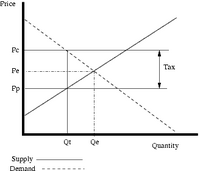

Value of used goods

Since the FairTax would not tax used goods, there is a common misunderstanding that this would create a differential, equal to the FairTax, between the price of new and used goods. Such a differential would certainly impact the sale of new goods like vehicles and homes. However, like the income tax system that contains embedded tax cost (see Supporting theories of effect), used goods would contain the embedded FairTax cost. While the FairTax would not be applied to the retail sales of used goods, the inherent value of a used good includes the taxes paid when the good was sold at retail. The value is determined by the supply and demand in relation to new goods. The price differential / margins between used and new goods would stay consistent as the cost and value of used goods are in direct relationship to the cost and value of the new goods.

Supporting theories of effect

Retail prices are inflated due to embedded taxes and compliance costs passed to the consumer by producers and suppliers. John Linder states the FairTax would eliminate almost all federal taxation costs from the supply chain, which could lower production costs by up to 30%. Americans For Fair Taxation has claimed that the production cost of domestic goods and services could decrease by approximately 22% on average after embedded taxes and compliance costs were removed, leaving the sale nearly the same after taxes. This is based on a study conducted by Dr. Dale Jorgensen, who found that producer prices would drop between 15% and 26% (depending on the type of good/service) after the switch to a consumption based tax. However, Jorgenson's research included all income and payroll taxes regardless of whether they were paid by employees or employers in the 22% embedded tax estimation. (It is also important to note that the Jorgenson model did not capture any reduction in the cost of compliance associated with changing from a complex income tax system to a simpler consumption tax.) This means that Jorgenson assumed that businesses would pass on all the cost savings from the repeal of payroll taxes and income tax withholding to consumers in the form of lower prices. Mathematically, this would have to result in employee take-home pay ( net income) remaining unchanged from pre-FairTax levels.

If businesses instead provided employees with their gross pay as expected (including income tax withholding and the employee share of payroll taxes), Arduin, Laffer & Moore Econometrics estimated production costs would decrease by a minimum of 11.55%. This decrease would offset a portion of the FairTax amount reflected in retail prices. These embedded costs include corporate taxes, compliance costs, and the employer share of payroll taxes (see Effect on tax compliance costs). The Beacon Hill Institute shows that it wouldn't matter whether prices fall or rise – the relative tax burden remains the same because if prices increased with the addition of the FairTax, wages would also rise accordingly; or if the federal reserve did not decide to accommodate (does not increase the money supply), then prices would fall and wages would remain at their net rates. Purchasing power for buying consumer goods and services in either situation would remain essentially the same, and the FairTax rate would be the same.

The decrease in production cost would only slightly apply to imported products, so, according to proponents, it would provide tax advantages for domestic production and increase U.S. competitiveness in global trade (see Border adjustability). Such logic is endorsed by a recent letter to the commission on tax reform by dozens of economists, including Nobel Laureate Vernon L. Smith. A study prepared by Nathan Associates for the National Retail Institute, which made many adverse assumptions, represents supporters' worst-case scenario for a consumption tax. The study predicts that the economy will grow only three percent more in ten years than it would have under the income tax and that the increase in consumption will be 1.15% less in the first year relative to what it would have been under the income tax. This study concludes that consumption will be higher in the fourth year and every year thereafter than it would have been under the income tax.

Effects on tax code compliance

FairTax supporters state that black market or illegal economic activity is largely untaxed under the current tax system. Economists estimate the underground economy in the United States at approximately $1 trillion annually. By imposing a sales tax, black market activity would be significantly taxed when proceeds from such activity are spent on legal consumption. For example, the sale of illegal narcotics would remain untaxed (instead of being guilty of income tax evasion, dealers would be guilty of failing to submit sales tax), but drug dealers would face taxation when they used drug proceeds to buy consumer goods such as food, clothing, and cars. By taxing this previously untaxed money, FairTax supporters state the black market would be paying part of their share of what would otherwise be uncollected income and payroll taxes.

It has been argued that if there were no net change in retail prices or tax burdens, the licit consumption of goods and services by the underground economy would continue to bear the same tax burden as before. Legal purchases under the current tax regime carry the hidden cost of implicit taxes. When an explicit tax replaces those taxes, the consumption purchases would still bear the same tax burden. However, the cost paid by the underground economy through embedded taxes is the cost associated with those paying into the income tax base. If black market activity was taxed today, the tax burden on the rest of the population would decrease from the larger base. Likewise, the large base of consumption would have illegal activity paying into the FairTax base.

Tax compliance

The current income tax system fails to collect on a significant percentage of taxes owed. The IRS estimates there are twenty additional cents of taxes owed on unreported income for every tax dollar collected. In 2001, the IRS estimated this shortfall to be over $312 billion. These figures do not include taxes lost on illegal sources of income, such as drug dealing.

Proponents assert that the transparency and simplicity of the FairTax would subject much of this unreported income to taxation. The number of tax collection points would significantly reduce as only retailers would file a tax return compared to every income earner. Research supports the claim that simplified tax systems lead to greater compliance. The IMF found that Russia's transition to a flat tax increased income reporting from 52% to 68% in one year. Similar results have occurred in Slovenia. The FairTax would reduce the number of tax filers by 80% and reduce the filing complexity to a simplified state sales tax form. The federal government would also be able to concentrate its entire tax enforcement efforts on a single tax – the FairTax. In addition, the overwhelming majority of purchases of goods and services occur in major retail outlets that would comply with the FairTax. Retailers would receive 1/4 of 1% as compensation for compliance costs.

FairTax opponents believe that tax compliance rates decrease when taxes are not automatically withheld or collected as tax liability is incurred. Compliance rates also fall when taxed entities, rather than a third party, self-report their tax liability. For example, ordinary personal income taxes can be automatically withheld and are reported to the government by a third party. Taxes without withholding and with self-reporting, such as the FairTax, can see evasion rates of 30% or more. William Gale has estimated that an evasion rate of 20% would require a FairTax rate of 39% to replace revenue lost through evasion. This would be a 65% rate when presented as a traditional sales tax.

The FairTax is a national retail sales tax, but can be administered by the states rather than a federal agency. This has a bearing on compliance, as the states' own agencies could monitor and audit businesses within that state. The .25% paid to the states amounts to 5 billion dollars the states would have available for enforcement. For example, California should receive over $500 million for enforcement. According to the California 2004-05 budget analysis, this is more than the $327 million California is spending to enforce the state's more complex sales and excise taxes. The FairTax is simpler, but extends to cover services which are not currently subject to the California sales tax. Because the federal money paid to the states for enforcement would be a percentage of the total revenue collected, the states would have an incentive to maximize collections.

University of Michigan economist Joel Slemrod argues, however, that states would face significant issues in enforcing the tax. "Even at an average rate of around 5 percent, state sales taxes are difficult to administer. Apparently the authors (of the FairTax) have not talked much to administrators who have to deal with, among other things, ineligible people declaring themselves to be businesses to qualify for the business exemption." This statement, however, is based on the understanding of state sales taxes, which differs from what would be allowed for personal and business purchases under the FairTax (see Personal vs. business purchases).

Underground economy

Opponents of FairTax argue that imposing a national retail sales tax would drive transactions underground and create a vast underground economy. Under a retail sales tax system, the purchase of intermediate goods would not always be taxed, since those goods would produce a retail good that will be taxed. Individuals and businesses may be able to manipulate the tax system by claiming that purchases are for intermediate goods, when in fact they are final purchases that should be taxed. Proponents point out that a business is required to have a registered seller's certificate on file, and must keep complete records of all transactions for 6 years. Businesses must also record all taxable goods bought for 7 years. They are required to report these sales every month (see Personal vs. business purchases).

While the superiority of consumption taxes is evident to many economists and tax experts, problems could arise with using a retail sales tax rather than a value added tax (VAT). A VAT imposes a tax at every intermediate step of production, so the goods reach the final consumer with much of the tax already in the price, along with some extra overhead. The retail seller has little incentive to conceal retail sales, since he has already paid much of the good's tax. Retailers are unlikely to subsidize the consumer's tax evasion by concealing sales. In contrast, a retailer has paid no tax on goods under a sales tax system. This provides an incentive for retailers to conceal sales and engage in "tax arbitrage" by sharing some of the illicit tax savings with the final consumer.

In the United States, a general sales tax is imposed in 45 states plus the District of Columbia (accounting for over 97 percent of both population and economic output). Most states also collect a variety of local sales taxes including county, city, and transit taxes. The United States has a large infrastructure for taxing sales that many countries do not have. Proponents respond to the underground economy argument by pointing out that, whereas tax evasion under the current income tax system requires only one person (the payer) to lie on their tax forms, tax evasion under the FairTax requires collusion of both the payer (the retail purchaser) and the payee (the retail seller). Furthermore, the number of individuals required to file taxes drops from approximately 135 million to 25 million. This 84% drop in the number of collection points will allow the tax administration to view tax fraud with greater scrutiny. Proponents of the FairTax see a substantial amount of additional tax revenue from those engaging in the black market, as a sales tax would require all who consume to be taxed (see Effects on tax code compliance).

Personal vs. business purchases

In order for an individual to purchase items tax-free for business purposes, the business would be required to be a registered seller with the state sales tax authority, who could collect the FairTax along with the state sales tax. The state would issue the business a registered seller's certificate. This would enable the business to purchase tax free from wholesale vendors, but they must give a copy of their registration certificate to the vendor to leave an audit trail. When an item is purchased for business use from a retail vendor, the business would have to pay the tax on the purchase and take a credit against the tax due on their sales tax return. Taxable property and services purchased by a qualified non-profit or religious organization 'for business purposes' would not be taxable.

Businesses would be required to submit monthly or quarterly reports (depending on sales volume) of taxable sales and sales tax collected on their retail sales to the tax authority. During audits, the business would have to produce invoices for the "business purchases" that they did not pay sales tax on, and would have to be able to show that they were genuine business expenses. Since 130 million individuals would no longer be filing tax returns, there would only be about 25 million businesses that could be audited. Advocates claim that this would greatly increase the likelihood of business audits, making tax evasion behaviour much more risky. Additionally, the FairTax legislation has several fines and penalties for non-compliance and authorizes a mechanism for reporting tax cheats and obtaining a reward.

To prevent businesses from purchasing everything for their employees, in a family business for example, goods and services bought by the business for the employees that are not strictly for business use would be taxable. Health insurance or medical expenses would be an example where the business would have to pay the FairTax on these purchases.

Transition effects

Because the FairTax proposal would replace various taxes with a single sales tax, several areas may experience unique effects through the transition.

Repeal of Sixteenth Amendment

If the FairTax bill were passed, permanent elimination of income taxation would not be guaranteed; the FairTax bill would repeal much of the existing tax code, but the Sixteenth Amendment would remain in place. Cases decided by the United States Supreme Court after the ratification of the Sixteenth Amendment have established that Congress has the power to enact an income tax even if the amendment did not exist. The elimination of the possibility that income taxation would return (through a separate Congressional bill), requires a repeal of the Sixteenth Amendment to the United States Constitution along with expressly prohibiting an income tax. This is referred to as an "aggressive repeal". The Constitution, however, does not require an income tax, it only allows one. Separate income taxes enforced by the State would be unaffected by the federal repeal.

Since passing the FairTax would only require a simple majority in each house of Congress along with the signature of the President, and enactment of a constitutional amendment must be approved by two thirds of each house of Congress, and three quarters of the individual U.S. states, it is possible that passage of the FairTax bill would simply add another taxation system. If a new income tax bill was passed after the FairTax passage, a hybrid system could develop. However, there is nothing preventing the addition of a national sales tax, or VAT tax, on top of today's income tax system. The Americans For Fair Taxation plan is to first pass the FairTax and then to focus grassroots efforts on HJR 16, sponsored by Congressman Steve King (R-IA), that calls for the repeal of the Sixteenth Amendment.

Congressman Linder, the bill sponsor, has stated "If the FairTax is enacted, I expect that the Congress and states would promptly begin consideration of legislation to repeal the Sixteenth Amendment. To make certain that occurs, however, I am in favour of adding language to H.R. 25 during the 110th Congress that includes a sunset provision, meaning that either we succeed in repealing the Sixteenth Amendment within 5 years after the implementation of the FairTax or the FairTax goes away. In my view, we simply cannot risk having both a national income tax and a national sales tax in place at the same time."

Effect on savers

Individuals under the current system who accumulated savings from ordinary income (by choosing not to spend their money when the income was earned) paid taxes on that income before it was placed in savings. When individuals spend above the poverty level with money saved under the current system, that spending would be subject to the FairTax. People living through the transition may find both their earnings and their spending taxed.

Critics have claimed that the FairTax would result in unfair double taxation for savers and suggest it does not address the transition effect on some taxpayers who have accumulated significant savings from after-tax dollars, especially retirees who have finished their careers and switched to spending down their life savings.

Supporters of the plan argue that the current system is no different, since compliance costs and "hidden taxes" embedded in the prices of goods and services cause savings to be "taxed" a second time already when spent. The rebates would supplement accrued savings, covering taxes up to the poverty level. The income taxes on capital gains, social security and pension benefits would be eliminated under FairTax. The FairTax would also eliminate what some claim to be the double taxation on savings that is part of estate taxes. In addition, the FairTax legislation adjusts Social Security benefits for changes in the price level, so a percentage increase in prices would result in an equal percentage increase to Social Security income. Supporters suggest these changes would offset paying the FairTax under transition conditions.

In contrast to ordinary savings, money in tax-deferred savings plans such as IRA, 401k, etc. would be withdrawn tax-free. There is currently $11 trillion in such accounts. This represents future tax revenue owed to the federal government under the income tax system, which has been estimated at $3 trillion. This revenue would then fall under the FairTax system for collection.

Time arbitrage

In the period before the FairTax was implemented, there could be a strong incentive for individuals to buy goods without the sales tax using credit. After the FairTax was in effect, the credit could be paid off using untaxed payroll. Opponents of the FairTax worry it could exacerbate an existing consumer debt problem. On the other hand, proponents of the FairTax note that this effect could also allow individuals to pay off their existing (post-FairTax) debt quicker. With the retail inventory tax credit, and the removal of embedded taxes in the retail prices of goods and services, it is unknown whether this will be an issue.

Grassroots movement

While initially financed by a group of businessmen from Houston, Texas, the FairTax has generated a large grassroots tax reform movement in recent years. This movement has been led by the Houston based non-partisan political advocacy group Americans For Fair Taxation. This organization claims to have spent over $20 million in research, marketing, lobbying and organizing efforts over a ten year period and is seeking to raise over $100 million more to promote the plan. Besides its paid staff in Houston, AFFT also includes volunteers who are working to get the FairTax enacted. The internet, blogsphere, and electronic mailing lists like Yahoo! Groups have contributed to informing, organizing, and gaining support for the FairTax. Many grassroots web sites have been created by supporters to help organize the effort and promote the plan. Popular web sites, such as FairTaxGroups.com and FairTaxBlog.com, serve as a resource for grassroots efforts by providing news, forums for discussion, national calendars, and event organization. Much support has been achieved by talk radio personality Neal Boortz. Boortz's latest book (co-authored by Georgia Congressman John Linder) entitled The FairTax Book, explains the proposal and spent time atop the New York Times bestseller list. Boortz stated that he donates his share of the proceeds to charity to promote the book. It is also a frequent topic of discussion on The Neal Boortz Show and a common gift to callers. In addition, Boortz and Linder have organized several FairTax rallies to publicize support for the plan. Other media personalities have also assisted in growing grassroots support including radio and former TV talk show host Larry Elder, radio host and former Senatorial candidate Herman Cain, Fox News and radio host Sean Hannity, and ABC News co-anchor John Stossel.